10.18.22 Market Update

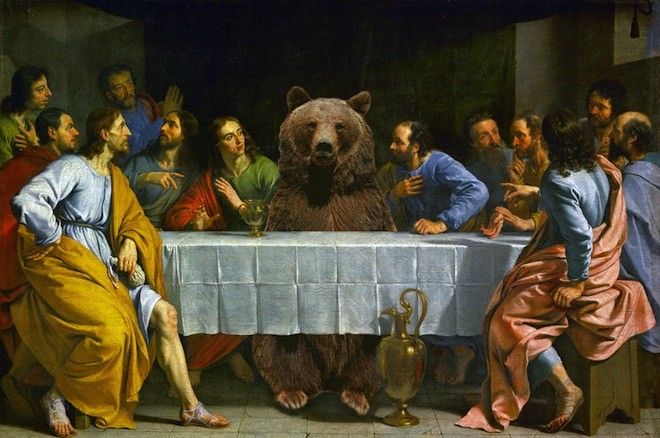

Boy has it been a wild few days on the market. Following our last post, things were looking grim, but just like with any good bear market, vicious rallies can occur. While it

Boy has it been a wild few days on the market. Following our last post, things were looking grim, but just like with any good bear market, vicious rallies can occur. While it

Wow what a crazy day! What we expected to be a boring/choppy day on the market turned out to be one filled with many twists and turns. This includes SPY making a

After what started that day as a slight recovery, SPY (our favorite ETF that tracks the S&P500) ended down -2.77(-0.76%). SPY is down back into our downward channel(

After a better than expected jobs report aka lower unemployment lower and higher Nonfarm payrolls better than expectations (show below), the market sold off hard, with the SPY ending down -2.79%. This

After a massive 2 day rally, the market has show us it is not quite ready to make its next big move. After being down almost -2% today and up to as high

Fresh off hitting a new yearly low last Friday, the bulls have raged back and have fought to break SPY out of balance to the upside and outside of the downward channel it

And just like that the bulls have fought back to, you guessed it, get SPY back into balance on the daily chart (the monthly and weekly charts are still down). We received a

It took all day but it finally happened. The S&P 500 broke out of balance to the downside. We are now down on the daily, weekly and monthly charts. This is

We are sad to report that the almost 2% pop to the upside experienced by the S&P 500 on September 28th was primarily traders who were covering their short positions. Large

Much to the global market's surprise, the UK government has gone against the actions of the US Federal Reserve and has started QE (Quantitate Easing) to save the value of the

Pigging backing off our post from yesterday, the S&P500 and SPY dipped below the year low and the June low, marking a new yearly low of 360.87 during regular trading

Day after day there is more and more blood in the streets. The fed is hiking rates (as expected) and the R word (recession) is popping up more and more. The S&