The Options Wheel Strategy: Rolling Your Way to Potential Profits

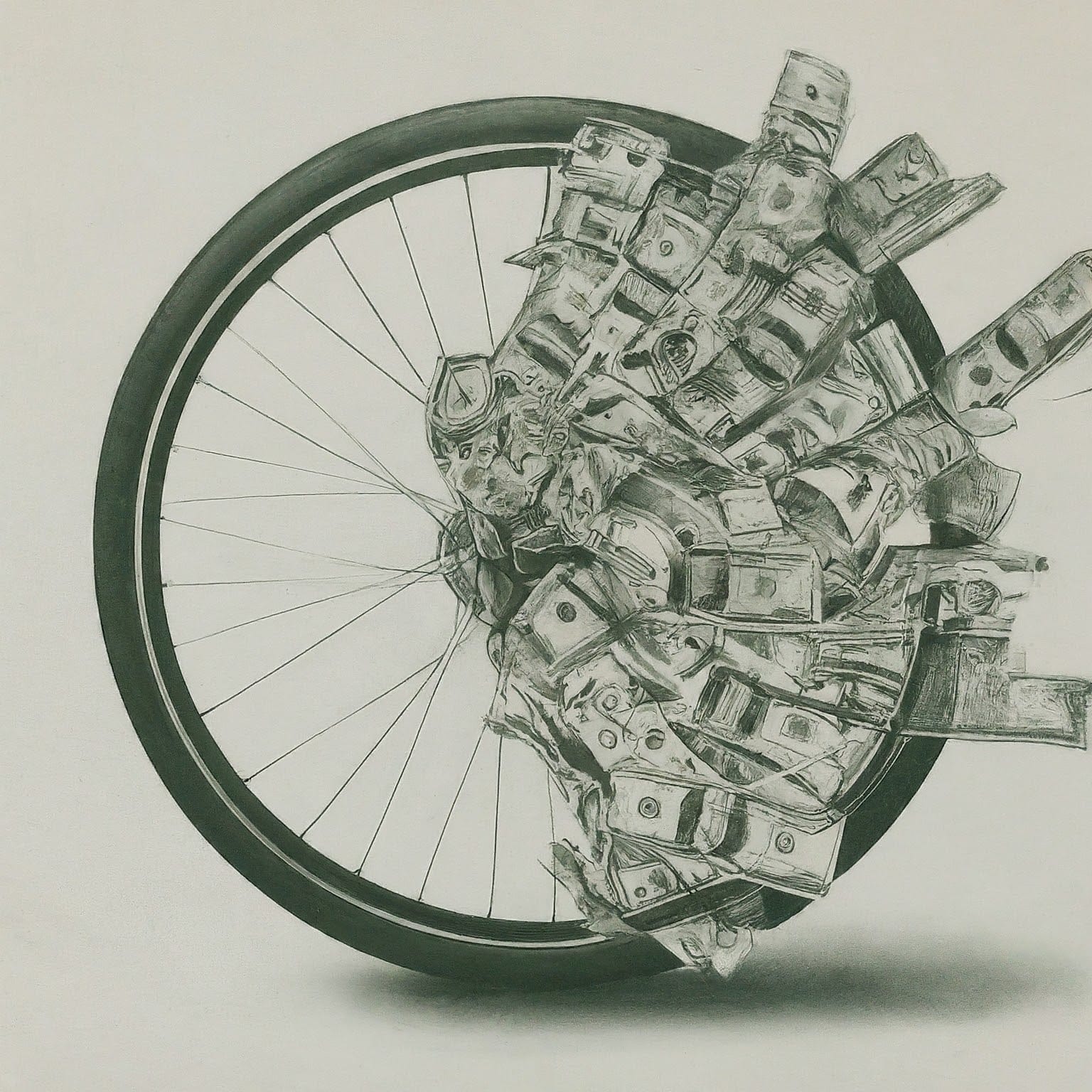

Are you looking for a systematic approach to options trading that combines income generation with the potential for stock ownership? Enter the options "wheel" strategy. This popular method blends two key options strategies—selling puts and covered calls—into a cyclical approach that aims to generate consistent income while potentially acquiring stocks at a discount.

What is the Options Wheel Strategy?

The wheel strategy is a three-phase cycle:

- Selling Cash-Secured Puts

- Owning the Stock (if put option is assigned)

- Selling Covered Calls

Let's break down each phase:

Phase 1: Selling Cash-Secured Puts

- Choose a stock you wouldn't mind owning.

- Sell out-of-the-money put options.

- Collect premium while waiting for potential assignment.

If the stock price stays above the strike price:

- The put expires worthless.

- You keep the premium and return to step 1.

If the stock price falls below the strike price:

- The put may be assigned, and you buy the stock.

- Move to Phase 2.

Phase 2: Owning the Stock

- You now own 100 shares per put contract assigned.

- Your cost basis is the strike price minus the premium received.

Phase 3: Selling Covered Calls

- Sell out-of-the-money call options on your newly acquired shares.

- Collect additional premium.

If the stock price stays below the call's strike price:

- The call expires worthless.

- You keep the premium and repeat Phase 3.

If the stock price rises above the call's strike price:

- Your shares may be called away.

- You profit from stock appreciation up to the strike price, plus premiums.

- Return to Phase 1 and start the cycle again.

Benefits of the Wheel Strategy:

- Consistent Income: Potential to generate regular income through option premiums.

- Lower Entry Points: Opportunity to acquire stocks at a discount to market price.

- Flexibility: Adapt to changing market conditions by adjusting strike prices and expirations.

- Defined Risk: Clear maximum loss potential, typically lower than outright stock ownership.

Considerations and Risks:

- Capital Intensive: Requires significant capital to secure cash-secured puts and own shares.

- Opportunity Cost: May miss out on significant upside if a stock rallies quickly.

- Assignment Risk: Must be prepared to buy the stock if the put is assigned.

- Stock Risk: Still exposed to downside risk when owning the stock.

Example of the Wheel in Action:

Let's say you're interested in XYZ stock, currently trading at $100.

Phase 1: Sell a $95 put for $2 premium, expiring in 30 days.

- If XYZ stays above $95, you keep $200 and repeat.

- If XYZ drops below $95, you buy 100 shares at $95.

Phase 2: You now own 100 shares with a cost basis of $93 ($95 - $2 premium).

Phase 3: Sell a $105 call for $1.50 premium, expiring in 30 days.

- If XYZ stays below $105, you keep $150 and repeat.

- If XYZ rises above $105, your shares are sold, realizing a profit.

Then, you return to Phase 1 and start again.

The options wheel strategy offers a structured approach to options trading that can potentially provide consistent income and opportunistic stock entries. It's particularly appealing to investors who have a neutral to bullish outlook on specific stocks and are comfortable with the mechanics of options trading.

However, like all investment strategies, the wheel comes with its own set of risks and requires careful management. It's crucial to choose stocks you're genuinely interested in owning long-term and to stay aware of upcoming events that could impact stock prices.

As always, consider your investment goals, risk tolerance, and market outlook before implementing any new strategy. The wheel can be a powerful tool in your investment arsenal when used wisely.